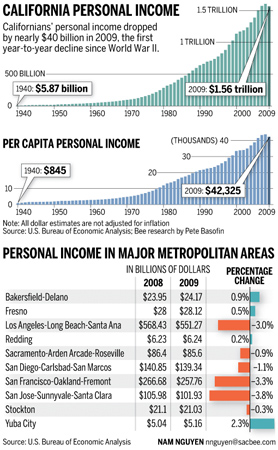

Government statisticians have put a number on Californians' paycheck pain last year: about $40 billion.

The federal Bureau of Economic Analysis said personal incomes of Golden State workers fell by that amount in 2009 compared with the previous year - the state's first year-to-year decline since World War II. In the Sacramento region, income was off about $800 million.

The bureau said 2009 income statewide totaled $1.56 trillion, down about 2.5 percent from $1.6 trillion in 2008. The 2009 level also came in just under the 2007 total.

California's decline was a third more than the national 1.8 percent personal income drop, reflecting the relative intensity of the state's recession.

State Department of Finance officials on Tuesday broke out bureau numbers for the Sacramento-Arden Arcade-Roseville region, showing personal income of about $85.6 billion in 2009, down about 1 percent from nearly $86.4 billion in 2008.

The numbers came as no surprise to analysts, state government officials and job industry professionals, given double-digit statewide unemployment and sagging industry segments throughout the California last year.

H.D. Palmer, a spokesman for California's Finance Department, cited three factors behind sliding 2009 incomes.

"The first was an overall drop in payroll jobs," he said, noting a loss of 898,000 non-farm positions, or 6 percent, in California last year.

Palmer also pointed to "what happened in the stock markets last year" (income losses tied to stock options and dividends) and "an overall drop in wages offset somewhat by unemployment benefits."

For those pounding the pavement, the pain goes beyond numbers.

Antelope resident Perry Beerman was among hundreds looking for work Tuesday at a job fair at the Sacramento Convention Center. He said he was on a fast track during his seven years at Sears Home Improvement, moving from a kitchen installer's job in San Diego to a regional manager's position in Sacramento.

Beerman was eyeing Sears' corporate offices in Chicago until two years ago, when he and 27 other regional managers were shown the door.

Married with a 16-year-old daughter, Beerman's been out of work since, minus $2,800-a-month take-home pay. He's cashed out his retirement and investments, and recently his unemployment benefits lapsed. He has started a handyman business but admitted "it's been rough since the unemployment ran out. It's tough even making rent."

Monique Spence of Wheatland has been searching for work since October last year, when she and other licensed vocational nurses were laid off from a Sacramento-area medical services company.

A caretaker's job for a family at their Wheatland ranch gives Spence a roof and a bed, but the $60,000 a year she earned as an LVN has been replaced by a $450-a-week unemployment check, plus a smaller stipend provided by stimulus funds.

"That's less than half of my gross, and I still have to pay taxes on it," she said.

Reduced incomes have been reflected in other ways. Californians have reduced retail spending, and state and local governments have felt the effects in lower tax revenue.

In June, the State Board of Equalization said it collected $48.4 billion in revenue in the 2008-09 fiscal year, about $4.7 billion less than the previous year. A primary factor, the board said, was a decrease of $68.5 billion (12.4 percent) in taxable sales from 2007-08.

Some experts noted that a rocky 2009 has passed, and there are signs of slow recovery this year.

Pamela Randall, regional director for the global staffing firm Manpower, said "Sacramento companies are starting to feel more comfortable adding to their head count and core staffing needs ... There are some signs that this region is continuing to grow."